owner draw vs retained earnings

It creates a negative drawings impact on the business. In other words retained earnings are accumulated earnings of a business after paying dividends or drawings to its stockholders or owners.

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

The owners loan will be adjusted against dividends or distributions when available.

. Or the opposite may occur. For example if a company earned 60000 in revenue and they have 40000 in expenses their net income is 20000. Sole proprietorship or partnership owners withdraw assets from their business for personal use.

A sole proprietor does not keep a separate account for retained earnings since he doesnt pay dividends out to shareholders or partners. If they then pay out 10000 in dividends to shareholders the retained earnings calculation would be. Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders.

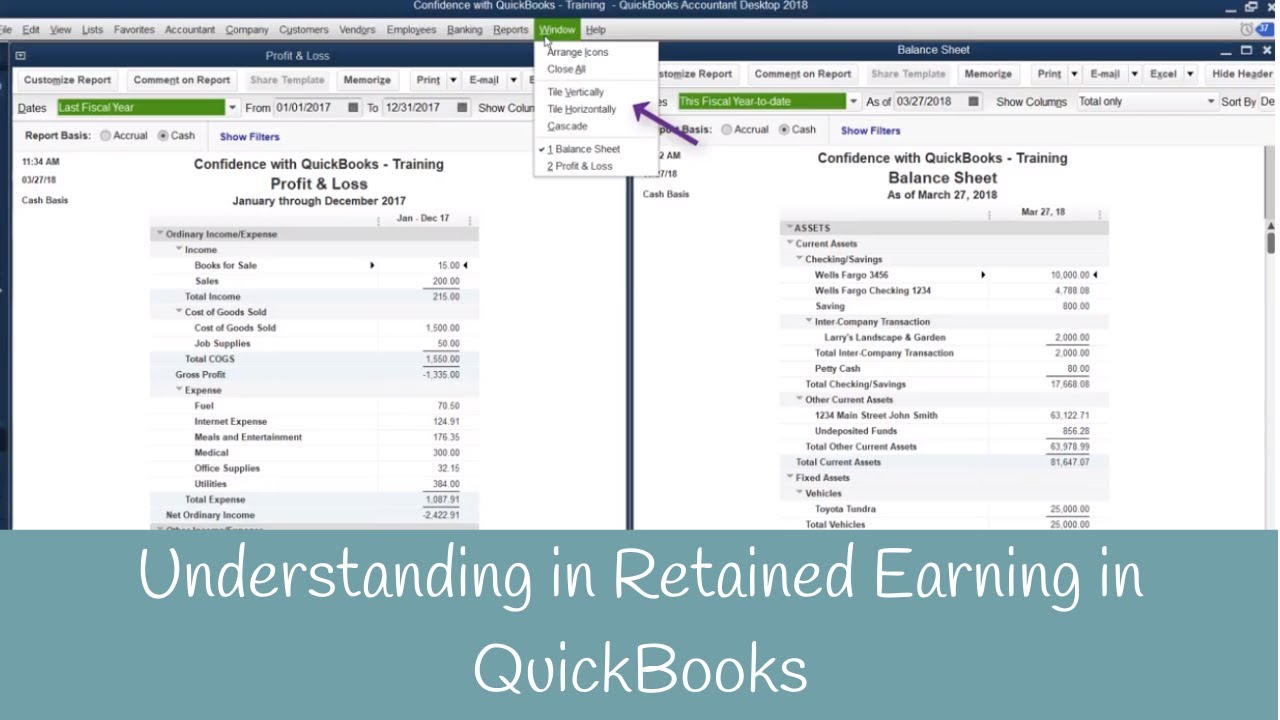

The one that does NOT have a Register view no matter what it is named is Retained Earnings or Owner Equity that QB sill close the prior year into. Owners Draw Taxes. Owners draws are withdrawals of a sole proprietorships cash or other assets made by the owner for the owners personal use.

Owners Draws 50000 Total Closing Owners Equity. Often directors and owners draw more funds than accumulated retained earnings hence the equity. I use Owners Equity as stated in its name.

This account is closed. Opening Balance Equity This account gets posted to when you create a new chart of account for a loan or item that you enter a opening balance for in the set up of the account in QuickBooks. Any money you contribute to the business that you dont expect to be repaid should be booked to this account.

There are differences in how each entity would interact with those 2 accounts. Owners draw is a temporary account which states the accumulated amounts an owner has withdrawn from the company presumably profits during a given year. Owners draws can be scheduled at regular intervals or taken only when needed.

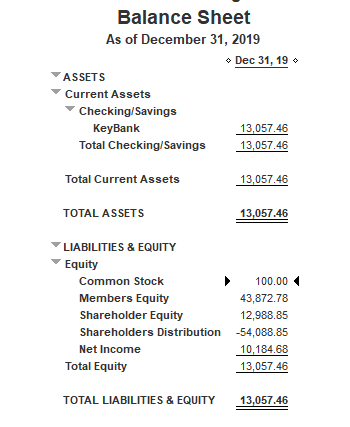

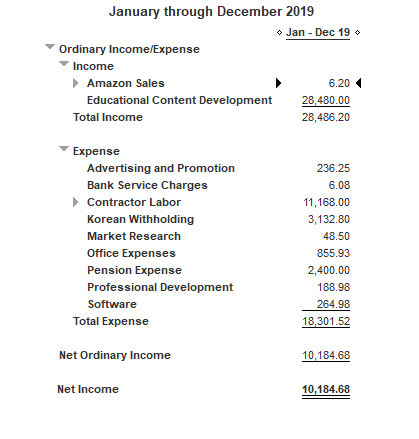

Retained earnings are a total of all the accumulated profits that a company has received and has not distributed or spent otherwise. The above picture is from data in QuickBooks Online. Accumulated earnings of the organization for the reporting year is the final financial result of its activities fewer dividends paid.

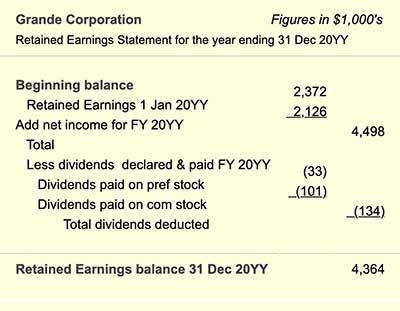

The business would record such overcompensations as directors or owners loans. You should also have an Owners Draws account in the equity section to record any cash you withdraw from the. A statement of retained earnings shows the changes in the.

An owners draw also known as a draw is when the business owner takes money out of the business for personal use. The WHY you took funds draw. Learn how to pay yourself from an owners draw in three steps.

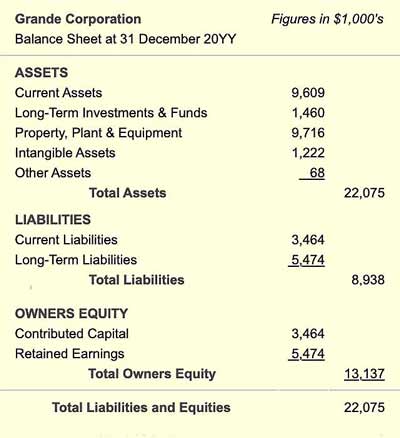

The three forms of business utilize different accounts and transactions relative to owners equity. Owners Equity Vs Retained Earnings And Business Taxes. Learn what retained earnings are how to calculate them and how to record it.

So if I understand correctly your contributiondrawing is negative. The owner still must keep track of his expenses revenues and net income as well as the money he keeps in the business and uses for equipment transportation postage salaries and other expenses. This account should be closed out to retained earnings and not carry a balance.

In the balance sheet. For clients I service I use Owner InvestmentDrawing for distributions and contributions. The account in which the draws are recorded is a contra owners capital account or contra owners equity account since its debit balance is contrary to the normal credit balance of the owners equity or capital account.

Retained earnings can also be accumulated losses. This is what is known as an accumulated deficit. Retained earnings are an integral part of equity.

As a business owner the owners draw allows you to take your share of cash out of the business. If you net the accounts together you should get partner capital. Answer 1 of 8.

Retained earnings is the amount of net profit or loss a company has accumulated since its inception. So for example a C-corporation distributing money from Retained Earnings has different tax consequences than a partnership. You want to create an account in your equity section called Owners Contributions.

In 1983 Warren Buffet put out his first Owners Manual for Berkshire Hathaway shareholders. You cannot set up Subaccounts here. If you are generating profits which I assume you are in order to continue taking draws then your retained earnings would be positive.

The accounts you are referring to are cumulative in Wave. Sole proprietors have owners equity. 0 20000 10000 10000 in retained.

As for Owner Equity open the chart of accounts and try to open each Equity account. Retained earnings is the primary component of a companys earned capital. It can decrease if the owner takes money out of the business by taking a draw for example.

One of the main differences between paying yourself a salary and taking an owners draw is the tax implications. It generally consists of the cumulative net income minus any cumulative losses less dividends declared.

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)

Which Transactions Affect Retained Earnings

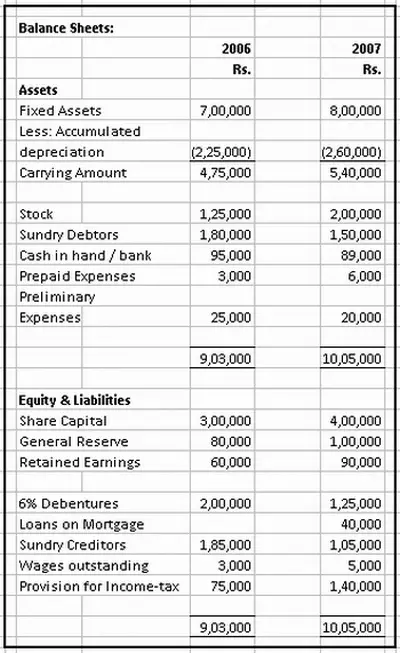

Ch01 Solution W Kieso Ifrs 1st Edi

How To Calculate Retained Earnings Formula Example And More

Retained Earnings Explained 5 Mins Youtube

Stock Investments By Arthik Davianti

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

How To Calculate Retained Earnings

Understanding Retained Earnings In Quickbooks Youtube

Stock Investments By Arthik Davianti

Cash Flow Statement Exercise With Detailed Solution

Debit And Credit Chart Accounting And Finance Accounting Career Accounting

Owners Equity Net Worth And Balance Sheet Book Value Explained

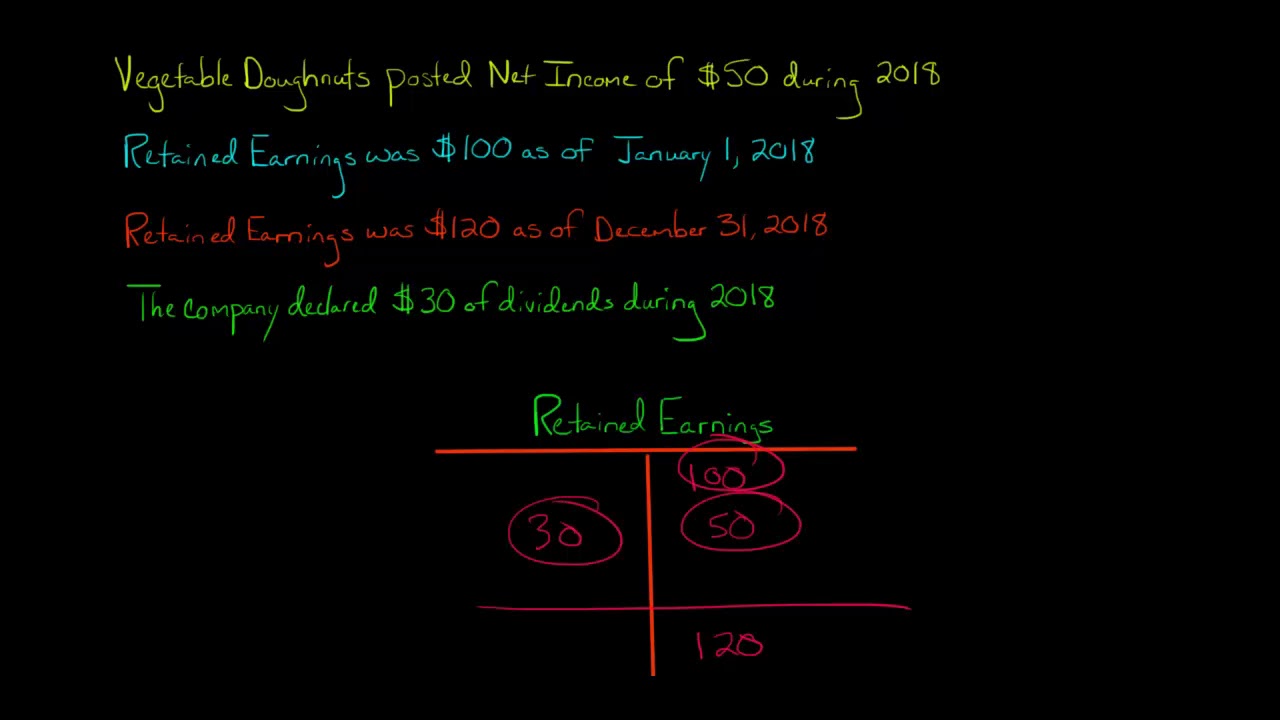

T Account For Retained Earnings Youtube

Retained Earnings Account Is Missing

Negative Retained Earnings Accounting Services

Owners Equity Net Worth And Balance Sheet Book Value Explained

Ch01 Solution W Kieso Ifrs 1st Edi

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template