rsu tax rate india

If share are listed on a foreign stock exchange Since no STT is paid such securities are considered unlisted securites for Indian tax returns. Here are the two challenges of this decision as I see it.

If you hold the RSUs for more than 3 three years than the entire amount of sale proceeds will be taxed as Long Term Capital Gain at the rate of 20 since the cost of acquisition of RSU would be nil in your case.

. RSUs offer several benefits to a companys employer and employees. In order to make employee compensation more manageable for tech companies at least a portion of it can be paid in the form. How Are Restricted Stock Units RSUs Taxed.

37 is too high. What are the taxation rules for RSUs in India. The nature of the gains will determine the amount of tax the employee will have to pay.

Hi Im a Resident of India working for MNC. On the other hand the rate for short term gains is the same as that for earned income which is 37 for high-income taxpayers. Some RSU receivers might opt to pay for the tax owed via personal check or would prefer the tax withhold via deduction of their paycheck.

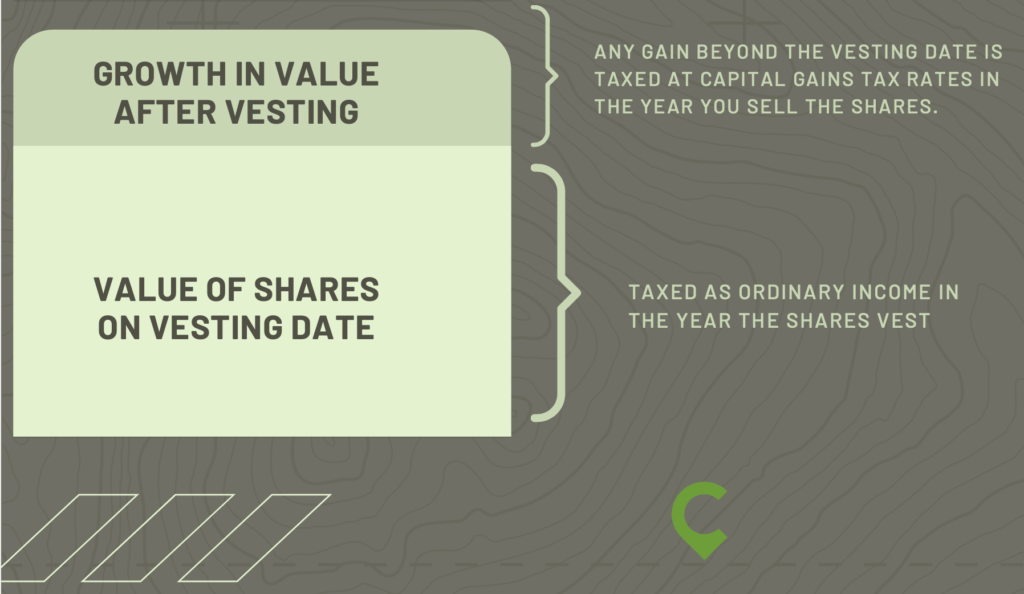

RSU Taxes - A tech employees guide to tax on restricted stock units. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them. Boosts morale and pushes them to perform to the best of their abilities.

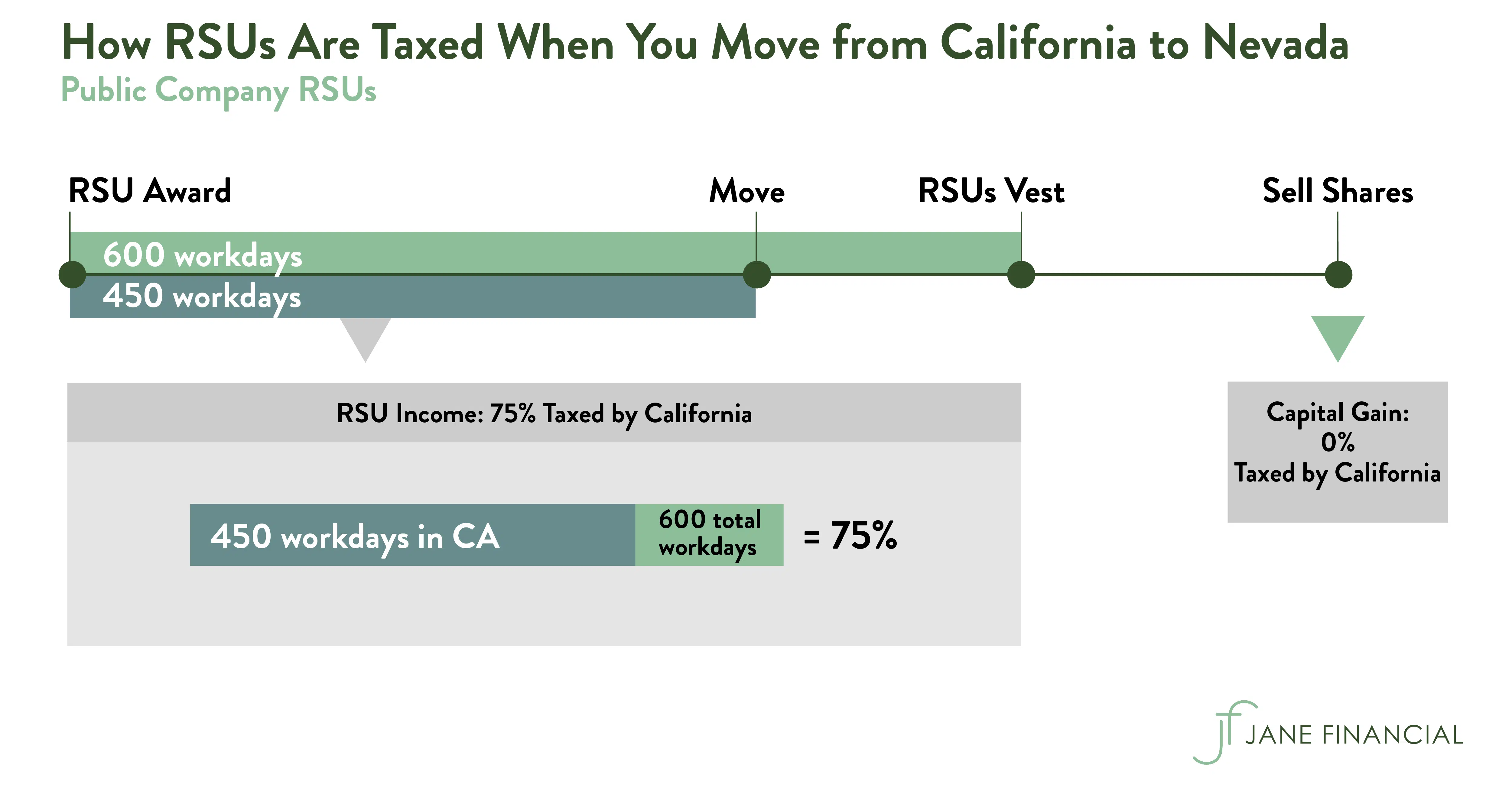

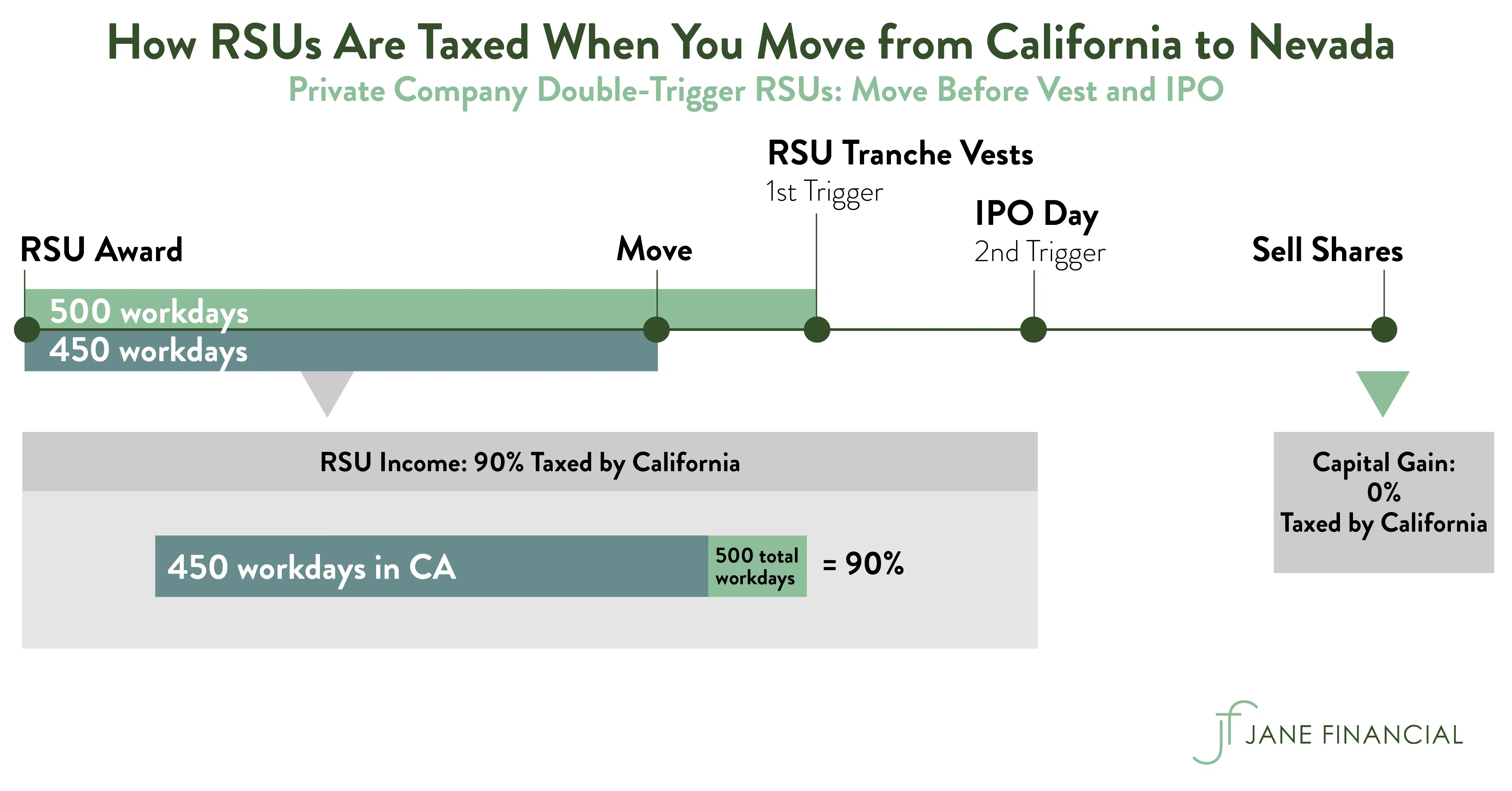

Tax treatment of RSUs in India The RSU perquisite is taxable based on the period of stay during the vesting period and resident status at the time of the grant of option. 22 is too low. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent.

For STCG where the securities transaction tax is applicable the applicable tax rate is 15 surcharge and health and education cess. Unlisted securities are considered long term after 36 months. Encourages an employee to remain as part of an organisation for a prolonged period.

The value of over 1 million will be taxed at 37. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent. Sometimes 37 the highest income tax rate can be very handy and 22 is too low for many people who work in tech.

This is different from incentive stock options which are taxed at the capital gains rate and tax liability is triggered when the options are exercised. Carol Nachbaur April 29 2022. So you have to pay tax on all Rs 1 lac however if its RSU of a public listed Indian company your tax will be NIL because of long term capital gains but if its a out side india listed company then 20 of 1 lac which is Rs 20000.

How it works in Google MicrosoftAdobeAmazon Walmart and what will be effective tax on allocated RSUs. If you live in a state where you need to pay state income taxes repeat steps 2 and 3 using your state marginal tax rate. How many RSU does Amazon give.

Restricted stock is a stock typically given to an executive of a company. The RSU which were allotted to you in India are the non-monetary benefits received in course of your employment and are hence considered has perquisites and a tax at source is deducted in India TDS on the market value of the RSU on the date they become vested in your hands say for eg the market price on that day in Indian rupees as 100 so the TDS 30 assuming that your. This happens over time through a vesting schedule.

The stock is restricted because it is subject to certain conditions. Most companies will withhold federal income taxes at a flat rate of 22. Short term gains are taxed at 15 while long term gains are exempt from tax.

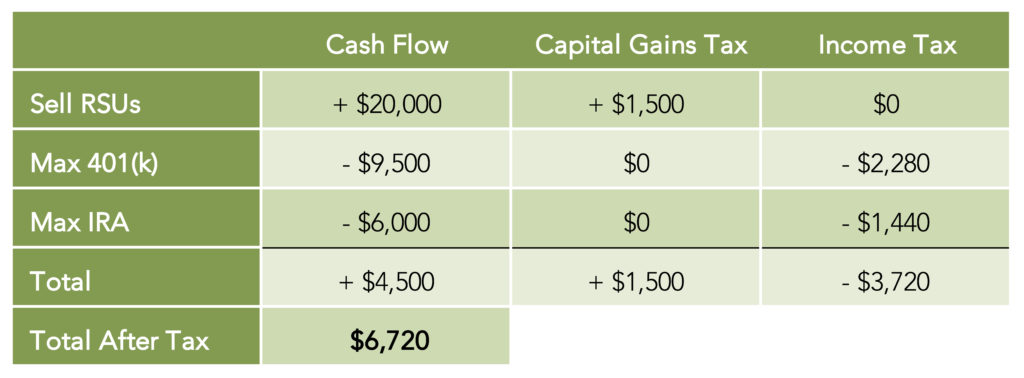

30 of G stocks in India. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Listed below are some of the benefits of restricted stock units you need to consider.

So it is nice that companies offer you that choice for the RSUs vesting on IPO Day. On the day if vesting 30 of the amount stocks are withheld and paid as tax to Indian Gov. At any rate RSUs are seen as supplemental income.

LOG IN or SIGN UP. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. Amazons RSU stock grant is backvested 5 vested in 1st yr 15 2nd yr 40 3rd yr 40 4th yr.

Since in your case the RSUs are listed on NASDAQ and not on any Indian Stock Exchange they are unlisted securities wrt Indian Direct Tax law. For one a recipient cannot sell or otherwise transfer ownership of the stock to another person until the restrictions lift. Restricted stock and RSUs are taxed upon delivery and subject to progressive income tax up to 56 percent.

When an employee sells their ESPP ESOP or RSU once the vesting period is complete and receive their money it is their duty to pay tax on that amount in India. Here is an article on employee stock options. In case the shares are sold with a year of acquiring them the gains resulting from such a sale.

Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry.

Restricted Stock Units Jane Financial

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

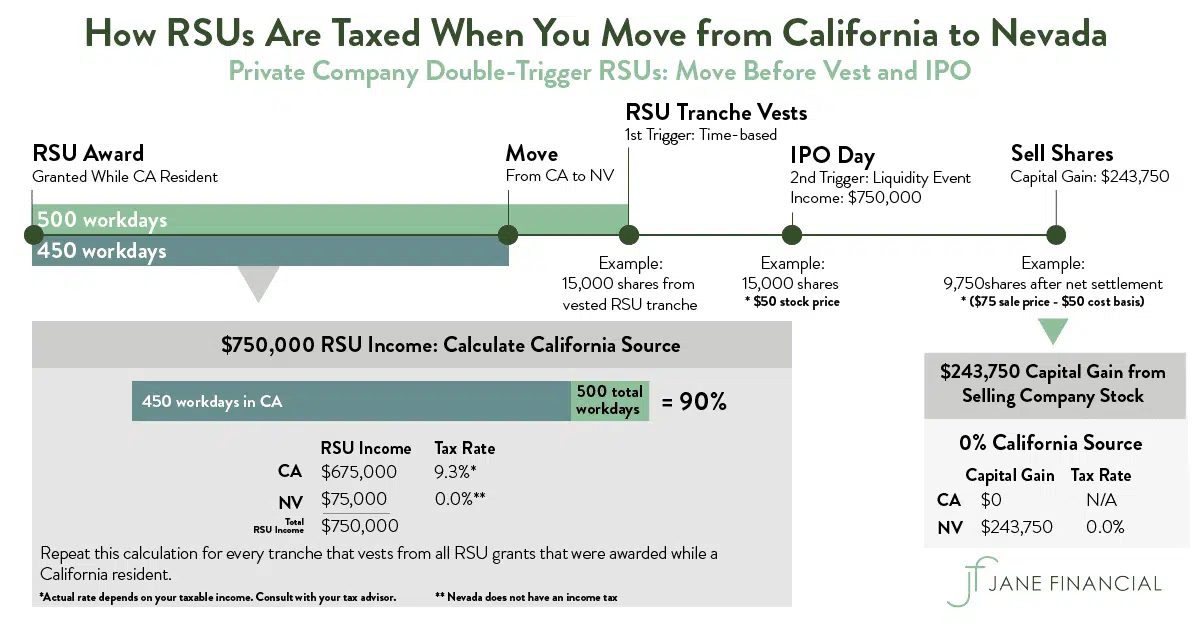

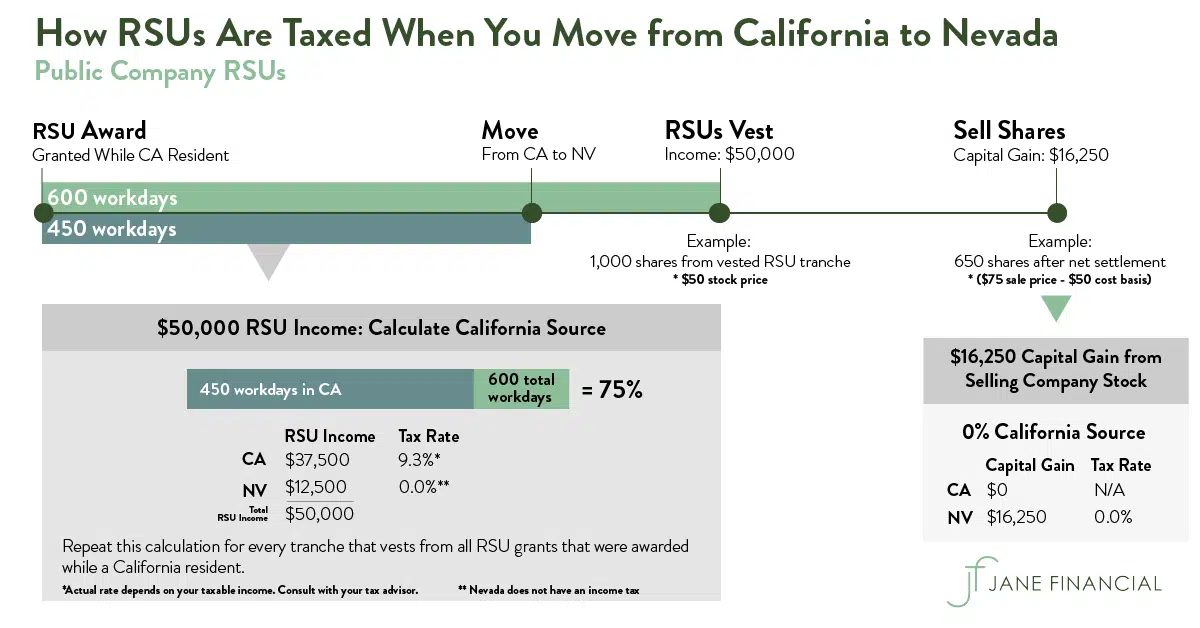

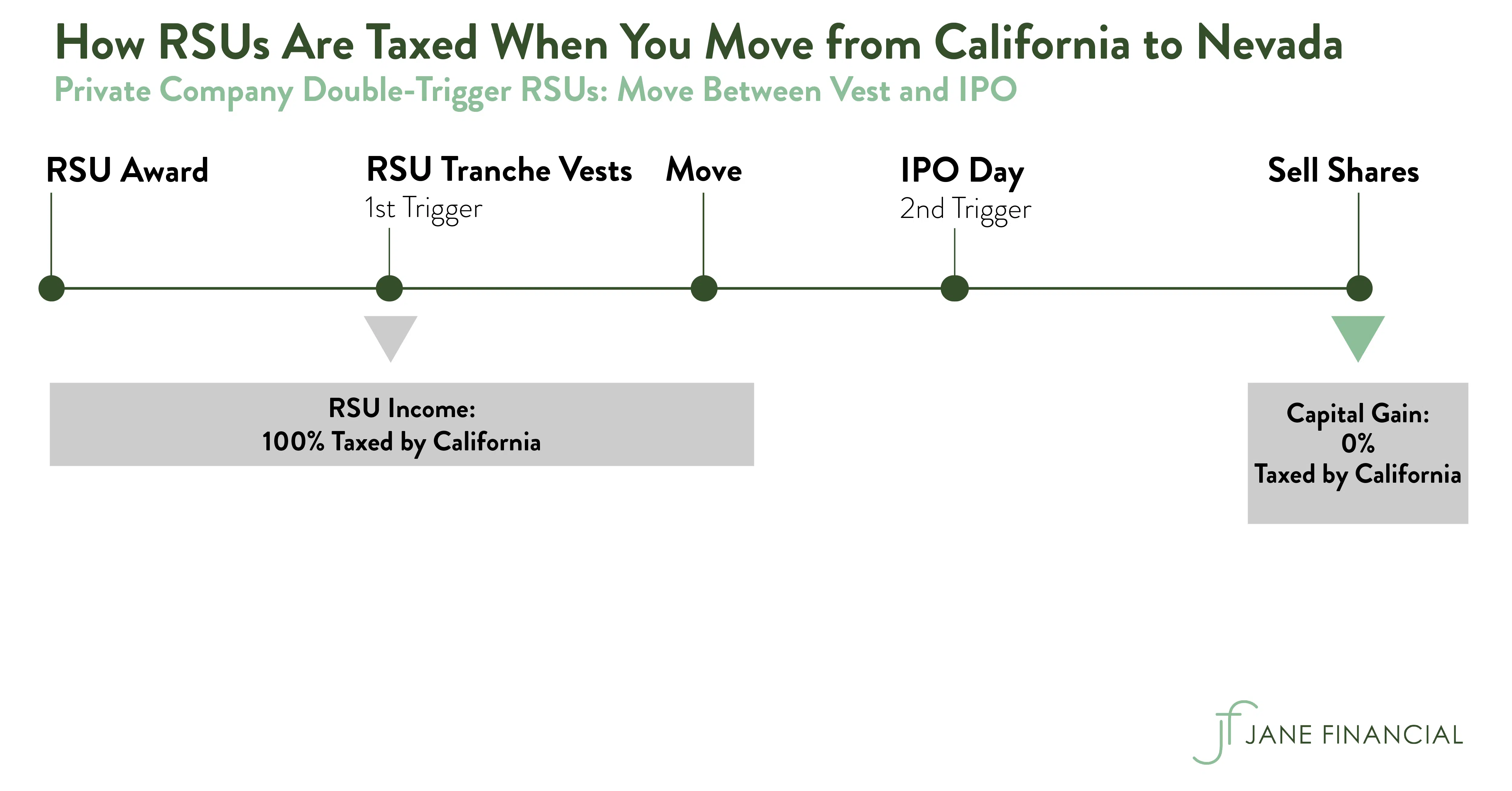

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

Restricted Stock Units Jane Financial

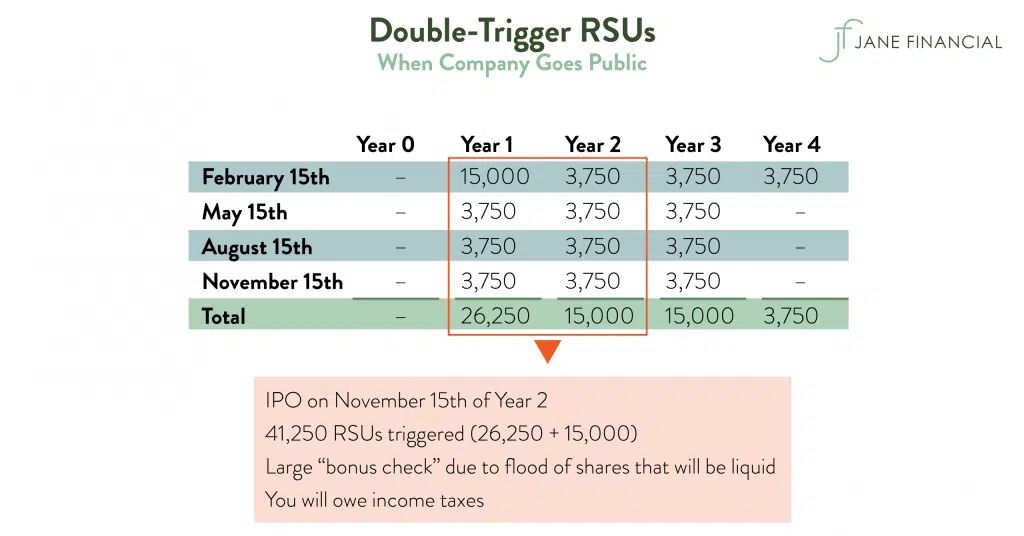

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Restricted Stock Units Jane Financial

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial